|

🛑 Stop what you're doing and log into your retirement account(s)! 🛑

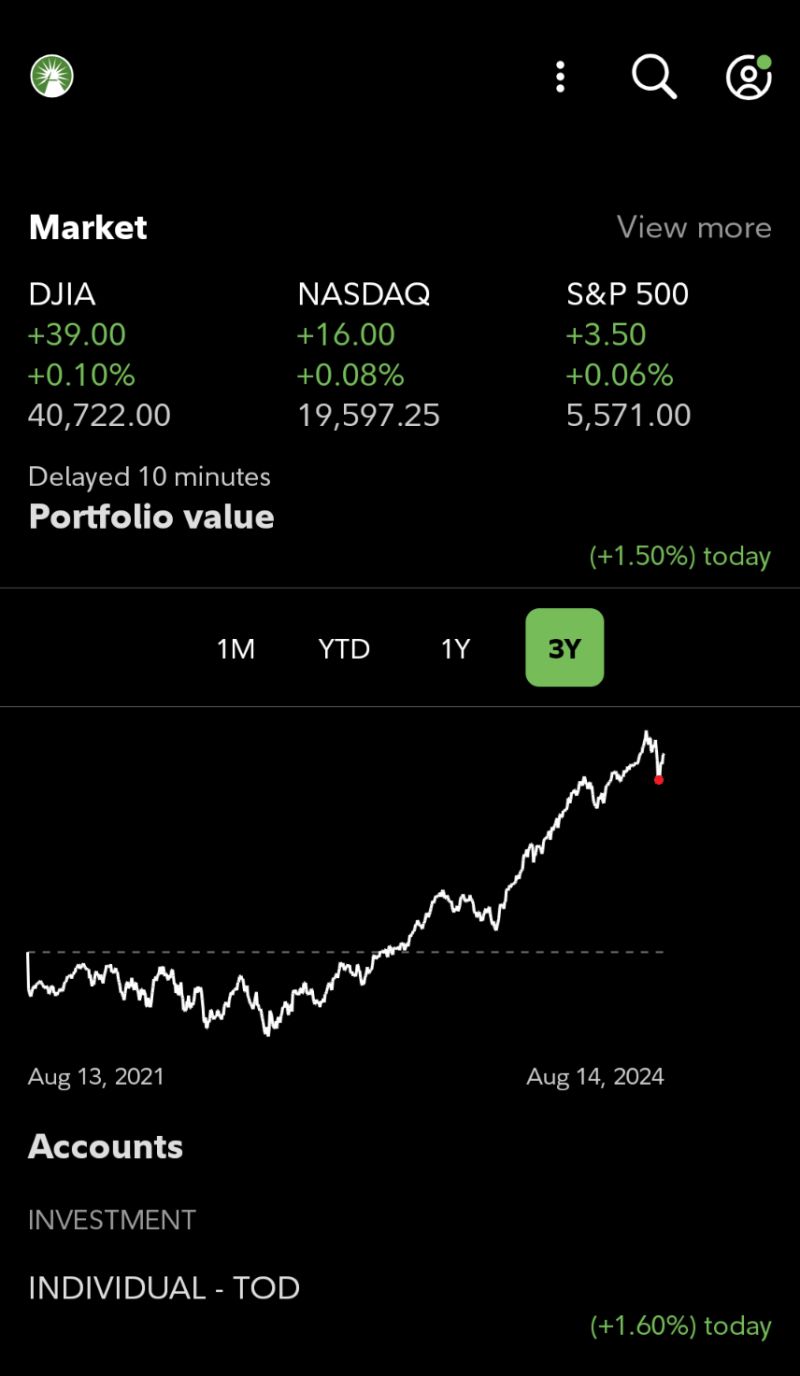

👉 Verify you're invested in something other than cash! (I just logged in to check my 401k and confirmed that most of it is in a low-fee total market index, while my IRAs are diversified across various asset class/market cap mutual funds.) 📊 Two of my friends recently discovered their "investments" had been sitting uninvested in their 401k accounts for years! 😱 Don’t let this happen to you—log in and make sure your money is actually working for you. 💼 Whenever a company is acquired, merges, or changes retirement benefit vendors, you might need to take action! Sometimes, your money gets defaulted into a money market fund or even cash (!). 🏦 This might not be ideal for your risk tolerance and time horizon. Current money market rates are around 5%, which might seem attractive if your money is sitting in your account just along for the ride, but consider this: 📈The Dow is up over 15%, NASDAQ up over 17%, and the S&P 500 index has climbed around 18% so far this year. 📈 Log in, verify your investment choices (a mutual or target date fund* are fine), and ensure your money is working for you. 💪 🔄 *Debatable opinion: Target date funds can sometimes have higher fees, but if you're looking for a "set it and forget it" option that adjusts risk as you approach retirement, they're a better choice than sitting in cash. Stepping off my soapbox... 📚 I'm happy to post about the differences between a Traditional and Roth 401k or IRA, but first things first—know where your money is! 🧐 I know where my money goes, and you should, too! 🚀 Stay the course, and don't let your investment accounts sit in cash! 🚀 How about you? Have you checked in on your investments lately? What are your thoughts on target date funds vs. other strategies? Share your opinions and let me know what other financial hot takes you'd like to see! 💬 #LesleysMoneyMatters #Investing #RetirementPlanning #FinancialAdvice #BuyandHold #FinancialPlanning #WealthBuilding #InvestorMindset #Finance #StaytheCourse

0 Comments

⏳ "Time in the market is better than timing the market."⏳ Someone asked me last Monday if I was going to start selling my investments, because "a recession is coming." 😱 (Aug 9th, the market experienced a 2.6% dip.) I replied that the market was on sale, and I was going to try to buy more. 🤓 Historically, the market has always gone up in the long run. Money is hard, because everyone has a unique psychology around investing, saving, and spending. If you are an investor or want to be one, create a plan, and stick to it. ↗ ⭕Yes, there will be blips in the market.⭕ ↘There might even be sizeable dips. ↘ Make the plan now, and stick to it. My Personal Investment Manifesto (my own letter to myself with my financial rules) reminds me: 🚫 If the market dips, don't panic. 🚫 Don't sell. 🏃♀️ This is a marathon, not a sprint. 🔮 I don't have a crystal ball, so I will never know the "bottom". 💸 When the market drops, "stocks are on sale." 💰 Review your financial situation, and if you have extra money beyond your emergency fund, buy more stock/ETFs. 👍 If you don't have extra money to buy, that's ok. 🚫 ❗ DON'T SELL! ❗ 🚫 The screenshot below is from my Fidelity app yesterday and shows my portfolio growth over the last 3 years. I stick to the plan, and I don't panic. The red dot is the market dip last week. What about you? How do you stay calm during market dips? 😊

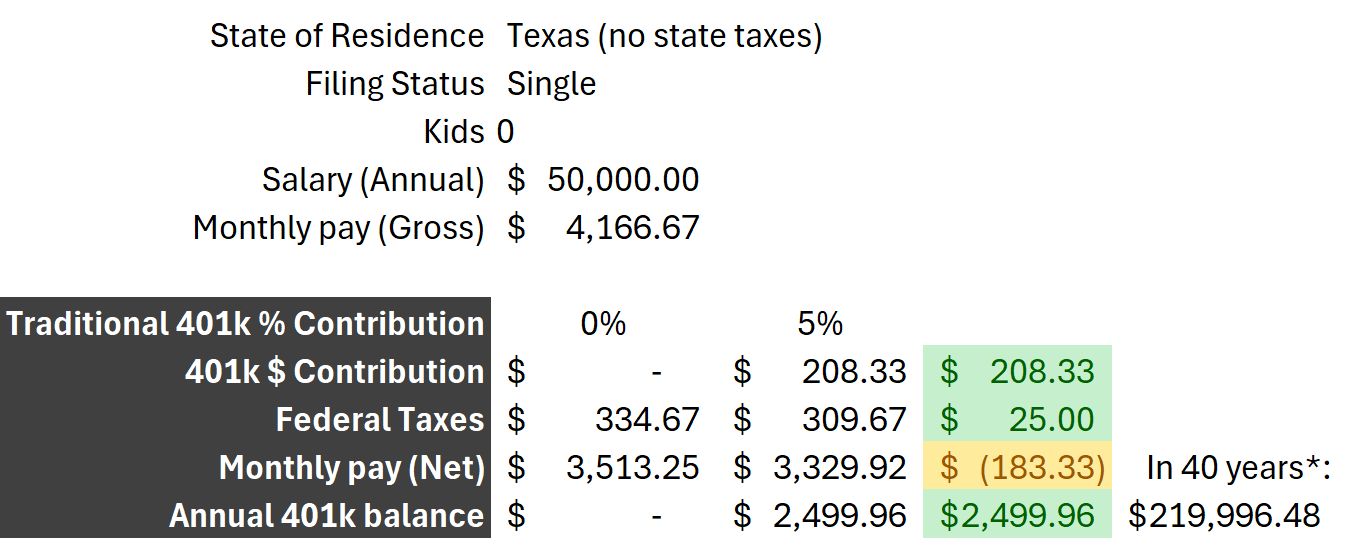

What's your saving or investing goal? Two weeks ago, I shared my Personal Finance Manifesto—a guide to creating a plan to navigate your financial journey. Today, I want to dive deeper into practical steps you can take to build on that foundation and achieve your financial goals. So what's your saving or investing goal? For some, it may be figuring out how to simply live paycheck to paycheck, while others may look to pay off high interest debt, buy a house, or save for a kids college. My Why: In 2008, I found out I have Multiple Sclerosis. I am doing well with treatment, but knowing that my quality of life could change drastically as I get older lit a fire under me to save as much as I could early on to be able to enjoy my life before I retire. I want to live my best life, and money certainly helps. Everyone's goals for why that want to grow their money are different, but luckily, the mechanism is the same: spend less, and save more. But to move forward, you sometimes have to look backward. I know, I know, if someone walks into a crowded room and utters the work "budgeting," everyone scatters. So let's not talk "budgeting." Let us instead celebrate income by identifying ways to keep it! The Original Four F-Words When you examine how your money is spent, it's worthwhile to take note of where the money goes. Review your income, bank and credit card statements, and any other resource that captures incoming and outgoing funds. I use Quicken and YNAB, but a simple spreadsheet works, too! I like using four categories to think through where my income (paycheck) goes: Fixed, Flexible, Fun, and Future. Fixed. These costs are required and have little to no wiggle room. Examples: rent, mortgage, car payment, insurance, and taxes. Temporary fixed could also includes diapers and childcare. While you can sell your house or car, you will always have some relatively-static living expenses. Flexible. These are required costs, as well, but there you have some control over their amount. Examples: Water, Electricity, Groceries, Gasoline. I can turn the thermostat up in the summer to reduce air conditioning spend, and I can buy "Manager's Special" (short-dated) foods at the grocery store to save on weekly grocery trips. Fun. These are the most flexible and extraneous expenses. The name is pretty straightforward: fun! Examples: Eating at a restaurant, going to the movies, or impulse buys from Amazon. These activities can be reduced or eliminated to save money. Pro Tip: When I want to buy something on Amazon, I put it in my shopping cart but wait until the next day to purchase. I end up hitting the "Delete" button about 90% of the time. Future. This one is the most squidgy. (It shouldn't be, but it is.) This category includes savings and investments. Examples: Emergency fund, college fund, retirement, investments. Many financial coaches say "Pay yourself first." I agree with this sentiment and would add to it: "Automate payment to yourself." My W2 paycheck has the normal deductions for taxes and benefits. I also contribute as much as I can into my Traditional 401k (pre-tax), which means the impact to my take-home pay is minimal. Pre-tax contributions are taken directly from your paycheck before your federal or state taxes are calculated. This lowers your adjusted gross income, and therefore your taxes are also lower on your income, which feels less impactful to your current-day pocketbook. Small Contributions Make a Big Difference To further illustrate, I used a basic 401k take-home pay calculator for comparison: For a single Texan with no kids earning $50,000/yr paid monthly, contributing 5% to a Traditional 401k results in $183 less take-home pay and accrues $208 in their retirement account each month.

Over a year, this amounts to almost $2,500. Over a career, though (based on The Money Guy's $88 earned per dollar over 40 years), the 5% from 1 year of contributions grows to almost $220,000 by retirement! I hide money in my "Future" bucket every paycheck for this reason. The Next Steps: Focus and Forecast So let's say you've covered all the F-words when identifying where your money goes. Then what? There are two more F words to consider: Focus and Forecast. Focus: Be mindful of spending, and stick to your plan. I have my credit cards saved in Google Wallet, so I use "tap to pay" almost exclusively. I don't touch physical money, and I don't even have to pull out a plastic card from my wallet to swipe in a machine. There's nothing tangible about paying at a vendor's point of sale, but I try to put thought into each transaction. When making purchases, even though it’s so easy with just 1 tap, ask yourself:

If any of these questions elicit a 'no,' take a pause to consider if the purchase is a want or a need. Forecast: Time is your most valuable resource. Once you know where your income is going, change the processes around you to enable your success! Automate payments directly from your paycheck, or even from your bank's checking account! I have most of my bills set up in "Bill Pay," allowing me to see "Upcoming Transactions" in my checking account before they send. This helps me verify that I have enough money in the account to cover upcoming bills and maintain a comfortable cushion for any unplanned expenses. I move the remaining balance to a high-yield savings account. Every minute spent automating your setup saves that much more time later to focus on what matters most. Pro Tip: Many banks allow you to add payees for thousands of companies, and some credit cards provide an "eBill" that includes a balance, minimum payment, and sometimes a full statement. From there, you can schedule to "Pay balance in full" every month. The Foundation of Your Flourishing Financial Future I may have gotten carried away with all the F-words, but I also know taking control of your finances can feel overwhelming! Celebrate your income by keeping more of it. Your goals are achievable. By understanding where your money goes and focusing on your spending habits, you can build a solid foundation for your financial future. Remember, it's not about perfection—it's about progress. Start with small changes and gradually build towards bigger goals. Recognize and celebrate your achievements along the way, no matter how small they may seem. Your Personal Finance Manifesto is a living document that will evolve with you, so revisit and revise it as your circumstances and goals change. I'm here to help you on this journey. If you have any questions or topics you'd like me to cover in future articles, please let me know in the comments or send me a message directly. Let's take this journey together towards a more secure and prosperous future. Stay tuned for more insights and tips in the next edition of Lesley's Money Matters!  I've been investing since I was 2 days old. Granted, I wasn't choosing which stocks went into my college fund, but my parents regularly discussed investing. They were also passionate about community service and sharing knowledge and time with others. I'm not a financial advisor, and this isn't legal financial advice, but I am an open book and happy to share my experiences: good, bad, or indifferent. Every person needs a Personal Finance Manifesto. You could call this your "Financial Values," "Personal Finance Plan," or whatever resonates with you. The key is to document your plan. When emotions run high—whether from excitement or fear—your plan becomes your guiding star. Sticking to a plan builds better habits and empowers you to make decisions within your own guardrails. I was born in Texas, and my journey goes something like this:

When I decided to return to Texas, my employer took back the $1,800 stipend they provided for the move to Wisconsin, and I had to pay another $1,800 for return-movers. This was the first time I carried debt on my credit card. It took me almost 2 years to pay off the debt plus interest. During this stressful time, I decided I needed to do better. So, I created my Personal Finance Manifesto. Lesley's Personal Finance Manifesto:

These core tenets guide my money management. l know where my money goes. In 2006, I tried to balance my checkbook (yes, with a literal flip pad). Writing down expenses helped, but I needed more structure. I bought a budgeting template from YouNeedABudget (YNAB—they have an app now), which helped me sort expenses and see where I was spending the most money. I cooked more at home, rented fewer DVDs, and looked for ways to cut expenses to pay off my debt. Nearly 20 years later, I check my bank account and credit card almost daily to check my spending, as well as watch for fraudulent transactions. I schedule bill payments directly from my checking account whenever possible, so that I can plan for upcoming expenses. I am a Saver. My first high school job paid $5.15/hr, and I (of course) spent most of my money at the movie theater. (I saw "The Matrix" three times that summer.) When I had my first job in college two years later, the novelty of practically living at a movie theater had worn off. With the money I had left on my $8/hr job, I decided to start automatically investing $25/month into a mutual fund. Today, every time I receive a raise or promotion, I give my contributions a raise, too. I am a Smart Spender. Everyone makes decisions on how they spend or don't spend their money. Some buy new cars, antique jewelry, lavish vacations, or travel to DisneyWorld two (or three or more) times a year. None of these decisions are bad; everyone has different priorities in life. My husband and I used to take a nice trip every other year, but we compromise on other spending by living in the same house for over a decade and driving older cars. For big purchases, I value quality over cost, spending time in Consumer Reports, Wirecutter, and spreadsheets to ultimately come to a final decision. For travel, I use points from our default credit card for hotels and rental cars, allowing for nicer trips at reduced costs. I love my Future Self. Every decision I make today impacts me tomorrow, and that means the impact is further extrapolated 5 or 10 or 20 years from now. Specifically talking investments, The Money Guy team calculated that every dollar invested 40 years ago is worth $88 today. The power of compounding growth is truly mindblowing! I have flexibility today I didn't have 20 years ago, and I'm excited about what that compounding and continued Future-Self Consideration will mean in another 20. I will stick to the plan. Money has a lot of emotional ties. In 2008, the stock market dipped 20%, and many sold their investments to stop the bleeding. It took 6 years for the market to recover, and we've had one of the longest bull runs since. Those that pulled their money out in 2008 missed out on 300%+ growth. Over these last 15 years, I've also heard "I'm waiting for the market correction to invest." Or in Feb/Mar 2020, "I'm just waiting for the bottom to hit." Time in the market is better than timing the market. You never know when the market is at its lowest, nor it's highest, so the best time to invest is now. I've been investing automatically for over 20 years, buying at both highs and lows, dollar cost averaging, and keeping to my plan. Historical returns suggest my investments will grow over the next 15-20 years. There are lots of resources online for an appropriate plan/order of operations, but they all trend toward a similar set of guidelines:

|

AuthorMy mission is to empower you with the tools and knowledge to achieve financial success. With 20 years of experience in technology and project management, I combine strategic problem-solving with a deep passion for financial literacy. ArchivesCategories |

RSS Feed

RSS Feed