|

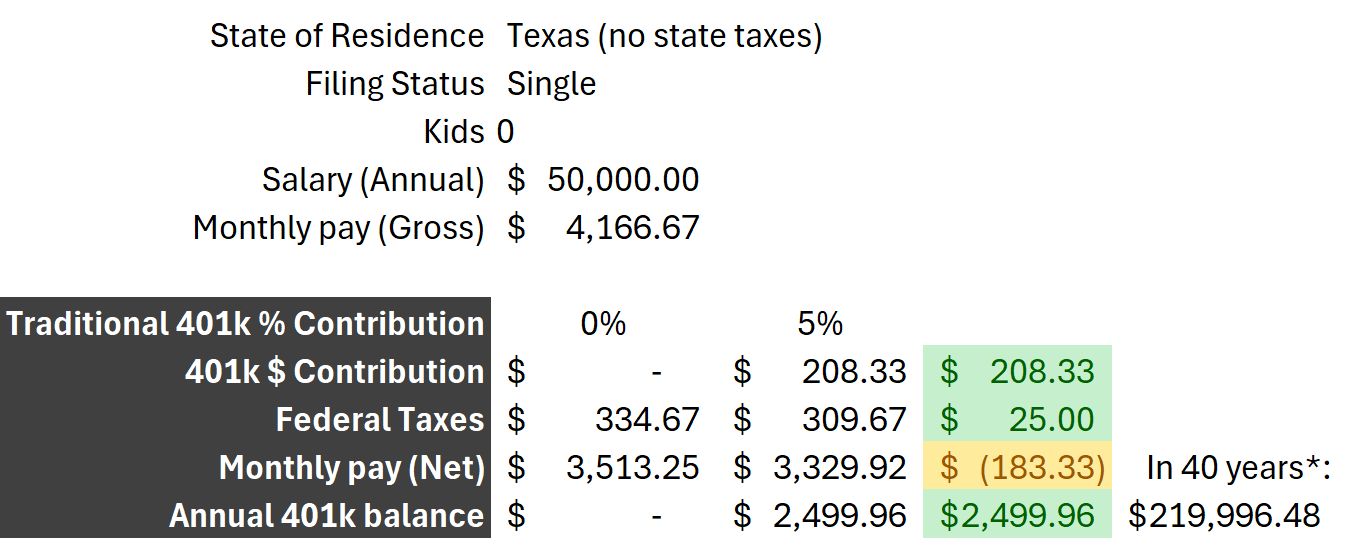

What's your saving or investing goal? Two weeks ago, I shared my Personal Finance Manifesto—a guide to creating a plan to navigate your financial journey. Today, I want to dive deeper into practical steps you can take to build on that foundation and achieve your financial goals. So what's your saving or investing goal? For some, it may be figuring out how to simply live paycheck to paycheck, while others may look to pay off high interest debt, buy a house, or save for a kids college. My Why: In 2008, I found out I have Multiple Sclerosis. I am doing well with treatment, but knowing that my quality of life could change drastically as I get older lit a fire under me to save as much as I could early on to be able to enjoy my life before I retire. I want to live my best life, and money certainly helps. Everyone's goals for why that want to grow their money are different, but luckily, the mechanism is the same: spend less, and save more. But to move forward, you sometimes have to look backward. I know, I know, if someone walks into a crowded room and utters the work "budgeting," everyone scatters. So let's not talk "budgeting." Let us instead celebrate income by identifying ways to keep it! The Original Four F-Words When you examine how your money is spent, it's worthwhile to take note of where the money goes. Review your income, bank and credit card statements, and any other resource that captures incoming and outgoing funds. I use Quicken and YNAB, but a simple spreadsheet works, too! I like using four categories to think through where my income (paycheck) goes: Fixed, Flexible, Fun, and Future. Fixed. These costs are required and have little to no wiggle room. Examples: rent, mortgage, car payment, insurance, and taxes. Temporary fixed could also includes diapers and childcare. While you can sell your house or car, you will always have some relatively-static living expenses. Flexible. These are required costs, as well, but there you have some control over their amount. Examples: Water, Electricity, Groceries, Gasoline. I can turn the thermostat up in the summer to reduce air conditioning spend, and I can buy "Manager's Special" (short-dated) foods at the grocery store to save on weekly grocery trips. Fun. These are the most flexible and extraneous expenses. The name is pretty straightforward: fun! Examples: Eating at a restaurant, going to the movies, or impulse buys from Amazon. These activities can be reduced or eliminated to save money. Pro Tip: When I want to buy something on Amazon, I put it in my shopping cart but wait until the next day to purchase. I end up hitting the "Delete" button about 90% of the time. Future. This one is the most squidgy. (It shouldn't be, but it is.) This category includes savings and investments. Examples: Emergency fund, college fund, retirement, investments. Many financial coaches say "Pay yourself first." I agree with this sentiment and would add to it: "Automate payment to yourself." My W2 paycheck has the normal deductions for taxes and benefits. I also contribute as much as I can into my Traditional 401k (pre-tax), which means the impact to my take-home pay is minimal. Pre-tax contributions are taken directly from your paycheck before your federal or state taxes are calculated. This lowers your adjusted gross income, and therefore your taxes are also lower on your income, which feels less impactful to your current-day pocketbook. Small Contributions Make a Big Difference To further illustrate, I used a basic 401k take-home pay calculator for comparison: For a single Texan with no kids earning $50,000/yr paid monthly, contributing 5% to a Traditional 401k results in $183 less take-home pay and accrues $208 in their retirement account each month.

Over a year, this amounts to almost $2,500. Over a career, though (based on The Money Guy's $88 earned per dollar over 40 years), the 5% from 1 year of contributions grows to almost $220,000 by retirement! I hide money in my "Future" bucket every paycheck for this reason. The Next Steps: Focus and Forecast So let's say you've covered all the F-words when identifying where your money goes. Then what? There are two more F words to consider: Focus and Forecast. Focus: Be mindful of spending, and stick to your plan. I have my credit cards saved in Google Wallet, so I use "tap to pay" almost exclusively. I don't touch physical money, and I don't even have to pull out a plastic card from my wallet to swipe in a machine. There's nothing tangible about paying at a vendor's point of sale, but I try to put thought into each transaction. When making purchases, even though it’s so easy with just 1 tap, ask yourself:

If any of these questions elicit a 'no,' take a pause to consider if the purchase is a want or a need. Forecast: Time is your most valuable resource. Once you know where your income is going, change the processes around you to enable your success! Automate payments directly from your paycheck, or even from your bank's checking account! I have most of my bills set up in "Bill Pay," allowing me to see "Upcoming Transactions" in my checking account before they send. This helps me verify that I have enough money in the account to cover upcoming bills and maintain a comfortable cushion for any unplanned expenses. I move the remaining balance to a high-yield savings account. Every minute spent automating your setup saves that much more time later to focus on what matters most. Pro Tip: Many banks allow you to add payees for thousands of companies, and some credit cards provide an "eBill" that includes a balance, minimum payment, and sometimes a full statement. From there, you can schedule to "Pay balance in full" every month. The Foundation of Your Flourishing Financial Future I may have gotten carried away with all the F-words, but I also know taking control of your finances can feel overwhelming! Celebrate your income by keeping more of it. Your goals are achievable. By understanding where your money goes and focusing on your spending habits, you can build a solid foundation for your financial future. Remember, it's not about perfection—it's about progress. Start with small changes and gradually build towards bigger goals. Recognize and celebrate your achievements along the way, no matter how small they may seem. Your Personal Finance Manifesto is a living document that will evolve with you, so revisit and revise it as your circumstances and goals change. I'm here to help you on this journey. If you have any questions or topics you'd like me to cover in future articles, please let me know in the comments or send me a message directly. Let's take this journey together towards a more secure and prosperous future. Stay tuned for more insights and tips in the next edition of Lesley's Money Matters!

0 Comments

Leave a Reply. |

AuthorMy mission is to empower you with the tools and knowledge to achieve financial success. With 20 years of experience in technology and project management, I combine strategic problem-solving with a deep passion for financial literacy. ArchivesCategories |

RSS Feed

RSS Feed